From $2K To $90K: The Wikicat Story Of A Zimbabwean Crypto Investor — But Here’s Why You Should Tread Carefully

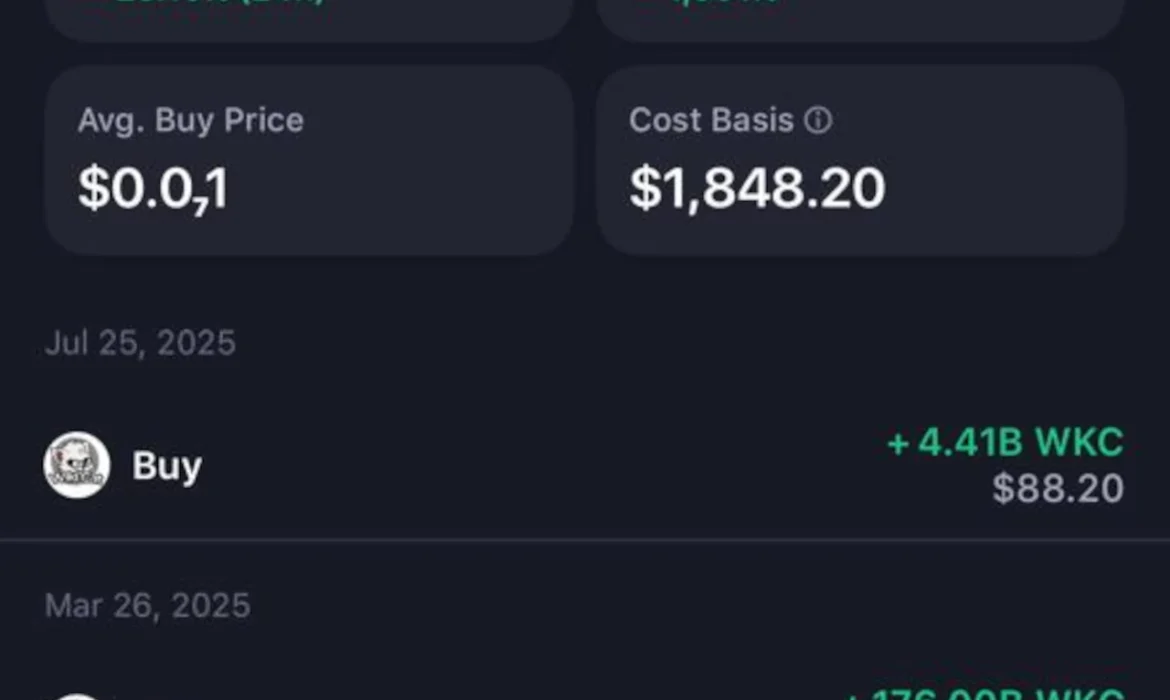

Stories of ordinary Zimbabweans striking big wins in cryptocurrency have become common talking points in cryptocurrency WhatsApp groups. One recent case stands out. A Zimbabwean crypto investor turned US$2,000 (≈ R37,000) into nearly US$90,000 (≈ R1.67 million) through a meme-coin called Wikicat (WKC). Though the token’s value later retraced to around US$40,000 (≈ R744,000), this remains a huge win. The crypto investor shared this journey in a WhatsApp group, with screenshots and wallet data to back it up.

“That US$2,000 you transferred me the first time… it grew to 40k.”

“Yakatombosvika pa 90 grand before the retracement” (It once reached US$90,000 before retracing).

Yet this remarkable gain comes with a warning. Meme coins such as Wikicat can skyrocket and crash just as fast. We explore how these tokens work, why they attract both excitement and risk, and what Zimbabweans should know before diving in.

What Are Meme Coins And How Did Wikicat Soar?

Wikicat belongs to a class of cryptocurrencies popularly known as meme coins. These are tokens that often begin as internet jokes or community projects but can attract massive followings.

Unlike Bitcoin or Ethereum, meme coins often have no intrinsic use beyond trading. Meme coins often lack utility. Their value comes from social media buzz, celebrity attention, or viral memes. They rise on sentiment, not fundamentals.

Dogecoin is the most famous example. Created in 2013 as a parody, it was once worth fractions of a cent. In May 2021, fuelled by social media hype and celebrity mentions, Dogecoin’s market capitalisation briefly exceeded US$80 billion (about R1.5 trillion).

Another case is Shiba Inu, which at its peak in October 2021 saw a rise of over 43,000,000% from its launch price. Early buyers who held on became multimillionaires.

Wikicat followed this playbook. The Zimbabwean crypto investor used USDT, buying it via EcoCash and bank transfers. Despite paying 5–8 percent in fees, he converted about US$2,000 (≈ R37,000) into WKC tokens. Over a few months, that stake ballooned:

“My wallet is exploding now all because of the USDT that you sold me.”

“Patience and discipline is very key,” he told his broker.

At its peak, the portfolio hit nearly US$90,000 (≈ R1.67 million). Even after retreating to US$40,000 (≈ R744,000), he still earned tens of thousands of dollars. Starting small and only risking what he could afford saved him from ruin.

Detailed Real-World Meme-Coin Examples: Wild Surges and Crashing Turns

To understand Wikicat’s rollercoaster, consider major meme-coin cases:

Dogecoin (DOGE)

Launched in December 2013, DOGE was a playful tribute to a Shiba Inu meme. It hit a 24-hour gain of over 800% in January 2021, reaching about US$0.07 thanks to Reddit hype and Elon Musk’s tweets. A month later, it leapt to US$0.45, trading nearly US$70 billion in a single day. Its market cap neared US$50 billion—after starting from a fraction of a cent. Wikipedia

Shiba Inu (SHIB)

Also riding Dogecoin’s tailwind, SHIB surged roughly 240% in a week in October 2021. Yet by November, the coin lost about 55 percent of value as the hype faded.

These rapid swings illustrate how meme coins amplify gains and losses.

$TRUMP Memecoin

Launched by Donald Trump on 17 January 2025, $TRUMP soared in value within hours. Its circulating 200 million tokens reached a diluted market value of over US$27 billion, benefiting Trump’s entities owning 80 per cent of the supply.

The coin peaked at US$75.34 just before the inauguration, then plunged. Yet the venture earned about US$350 million from sales and trading fees within weeks.

A contest offering a private dinner with Trump triggered a 50–60% price jump. Once winners emerged, the tokens collapsed—many sold immediately. Hundreds of thousands of wallets suffered losses.

This illustrates “pump-and-dump” dynamics at scale. A few insiders profit while many lose.

YZY (with Kanye West)

Artist Kanye West launched the meme coin YZY. Within hours, it spiked to US$3 billion in valuation, then dropped two-thirds amid mass sell-offs. Over US$20 million in investor losses occurred.

The Risks And Rewards In Context

Wikicat’s story echoes these broader examples. A modest bet turned into a fortune. But meme coins can also reverse fast, leaving latecomers with nothing.

Key risks include:

-

Extreme volatility — as shown by DOGE, SHIB, $TRUMP, YZY.

-

Pump-and-dump schemes — insiders hype, gather, then exit.

-

Lack of utility — tokens may lack real use beyond speculative trading.

-

Fees and market friction — local buyers pay steep costs via services like EcoCash.

-

Ethical or legal concerns — seen in political meme coin controversies.

The Zimbabwean investor applied smart tactics. He started small. He secured at least US$2,000 early to ensure that he got his capital back.

“So far I have taken only US$2,000. I will take a good amount a bit later in September.”

This discipline cushioned him as Wikicat fell back.

What Should Zimbabwean Crypto Investors Know? (An Explainer For Beginners)

1. Start Small

Only invest what you can afford to lose. The initial US$2,000 was a calculated gamble.

2. Take Profits Early

Don’t wait for peaks. This crypto investor took partial gains while still in profit.

3. Beware WhatsApp Tips

Avoid investing based solely on messages or hearsay. Do your own research.

4. Understand Fees

EcoCash and agent fees reduced his returns. Always factor in transaction costs.

5. Use Trusted Tools

Track tokens on reputable platforms like CoinMarketCap or CoinGecko.

6. Recognise Meme-Coin Nature

They often thrive on hype and collapse on sentiment. No tangible value supports them.

7. Learn from Real-World Cases

Dogecoin and Shiba Inu soared, then crashed. $TRUMP went from billions to bust overnight. YZY surged then tumbled. These patterns repeat.

8. Watch for pump-and-dump structures

As seen with $TRUMP’s dinner event—price jumps followed by rapid dumps.

A Zimbabwean Moment: Profit That Still Mirrors Risk

In a land where inflation undermines savings and banks often fail to provide stability, crypto offers both opportunity and hazard.

Wikicat delivered life-changing returns, but only because of careful entry, vigilance, and discipline.

This story underscores the power of digital markets. It also highlights how quickly fortunes can reverse.

The Wikicat story captures this duality perfectly. It shows the power of digital markets, but also the razor-thin line between success and loss.

Final Word

Wikicat’s meteoric rise is impressive. Starting with US$2,000 and reaching US$90,000 seems like a fairy-tale. Y

But meme coins are not magic. They are volatile, speculative, and often driven by hype or celebrity—not substance. Real-world examples from Dogecoin to YZY show that.

For Zimbabweans turning to crypto as a hedge against inflation and uncertainty, discipline and patience are crucial. They must match curiosity with caution. Start small, take profits early, and never invest more than you can afford to lose.

The opportunities are real, but so are the dangers. In digital money, as in farming or business, success requires patience, research, and strategy.

Follow Us on Google News for Immediate Updates

The post How A Zimbabwean Crypto Investor Turned US$2K Into US$90K With Meme-Coin Wikicat appeared first on iHarare News.